Breaking News

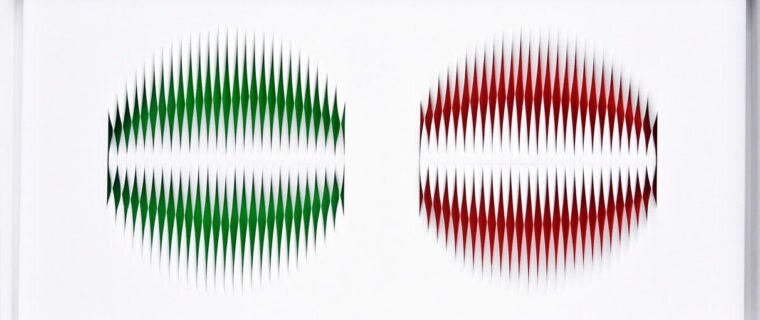

- 10:43Un anno fa l’installazione di Meggiato, emblema di unione universale

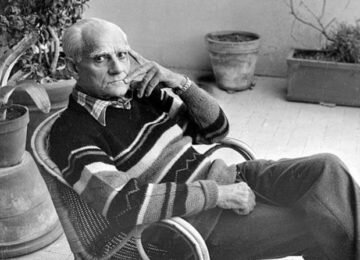

- 11:40Il grido di allarme di Alberto Biasi: Italia matrigna con l’arte

- 20:34Quei lunghi giorni di isolamento forzato: la dura lezione del virus

- 18:35Scomparso a 84 anni Christo

- 15:54Eduardo, Senatore del Regno di Napoli